Introduction

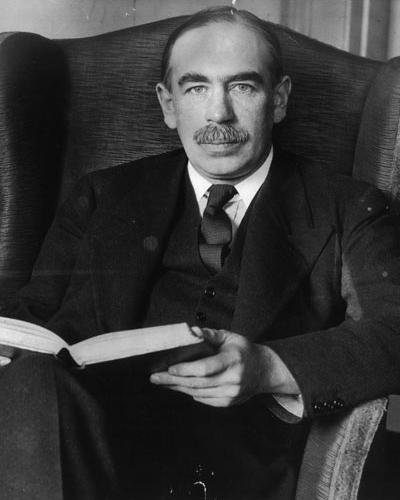

John Maynard Keynes (1883–1946) was the most influential economist of the twentieth century and, after Adam Smith, one of the two most influential economists of the modern age. Two of his books, The Economic Consequences of the Peace (1919) and The General Theory of Employment, Interest, and Money (1936), were among the most important books on economics and politics published during the last century.

Keynes was the principal theoretical architect of the post-war economic order in which governments assumed responsibility for stabilizing economies and promoting employment through spending, regulation, and debt. The evolution of “managed economies” in the post-war era owed a great deal to Keynes’s writings in the 1930s, in which he established full employment as the proper goal of economic policy and provided policy-makers with a set of fiscal tools whereby they might try to smooth out the booms and busts of the business cycle. This was the “middle way” that Keynes tried to steer between the extremes of communism and fascism and between state planning and free market capitalism. From a political point of view, Keynes was among the liberal reformers of that era who sought to “tame” capitalism by assigning new managerial duties to national governments.

Keynes was by no means solely an economic theorist, but a thinker with the widest range of interests. Keynes was a political economist in the tradition of Adam Smith, John Stuart Mill, Joseph Schumpeter, and Friedrich Hayek. His work wove together the interconnected subjects of politics and political institutions, culture, history, psychology, and economic theory. Robert Skidelsky, Keynes’s biographer, asserts that he was as much a moralist as an economist. Keynes, he wrote, searched for a vision of capitalism that promoted both efficiency and justice in equal parts. Nor was Keynes an “armchair” or academic theorist: he participated actively in every important political debate that took place in Great Britain during the tumultuous years from the outbreak of World War I through the close of World War II. He believed that progress in economics must arise from the interplay between theory and urgent practical problems.

Keynes was a “liberal revolutionary” whose aim was to place the capitalist order on different economic, political, and cultural foundations than those inherited from the nineteenth century. Keynes was sensitive to the historical nature of the capitalist system as it evolved through different phases, created new institutional forms, and adapted to crises and new challenges. He questioned whether it was still appropriate to use theories formulated in 1800 or 1850 to account for the economic realities of the 1920s and 1930s. He wrote in the 1920s that “the age of laissez faire” (as he called it) had been made obsolete first by the development of large corporations and labor unions and then by the destructive effects of the world war. If the old order was dead, then a new one had to be built upon new intellectual foundations. This was the campaign that Keynes engaged in during his interludes of public service and in the books and articles that he wrote between 1919 and his death in 1946.

There are five general subjects that require consideration in regard to Keynes’s life and career: (1) The Economic Consequences of the Peace; (2) the evolution of the capitalist order; (3) the Great Depression and The General Theory; (4) World War II and the Bretton Woods system; and (5) Keynes’s post-war legacy.

The Economic Consequences of the Peace

For Keynes and his generation, the “great war” of 1914–18 shattered the foundations of European civilization. The old order in Europe was built upon a network of interlocking principles and ideals: Protestantism and Victorian morals in culture; nationalism, empire, and monarchy in politics; laissez faire, free trade, and the gold standard in economics. The great question after the war was whether the symbols and institutions of the old order could survive in a new era of sovereign debt, despair and dashed hopes, debauched currencies, and a permanently changed balance of world power. Keynes did not think that they could.

Keynes’s reflections on the war and the damage it did to the social order were set out in The Economic Consequences of the Peace, the polemical exposé of the Paris Peace Conference that he wrote in a few months in 1919 after serving as a member of the British delegation to the Conference. Keynes predicted that the Treaty of Versailles, unless revised, would lead to financial ruin across Europe and possibly to a new and even more destructive war. The book was an immediate best seller and it turned Keynes into an international celebrity. It ran through five editions and was translated into eleven languages within a few years.

In Keynes’s view, the war fatally disrupted the delicate balance among the various factors of trade, psychology, population, and investment upon which the pre-war order was constructed, leaving millions on the continent starving and destitute when the war ended. Nearly 40 million people (mostly Europeans) were killed or wounded during the course of the war; factories and transportation grids were destroyed across large swaths of the continent; food and medicine were in short supply; all countries were in debt (mainly to the United States) due to vast borrowings to pay for armaments; national currencies were of uncertain value in relation to one another due to wartime inflation; and the accumulated wealth of the Continent was consumed in a few years of war. The suffering was magnified by comparison with the comfortable lives Europeans enjoyed before 1914 and with the optimistic hopes for the future that nearly everyone had entertained just a few years before.

Most observers, including Keynes, expected the French, British, and American leaders who controlled the Peace Conference to craft a treaty that incorporated President Wilson’s Fourteen Points. Keynes stressed various elements of Wilson’s program that pointed away from a punitive settlement. Nevertheless, after six months of negotiations, running from January to June (1919), the Conference adopted a regime of reparations and territorial concessions designed to punish Germany by making her bear most of the costs of the war. The Treaty assigned to Germany the entire blame for the war, and forced her to disarm and to cede territories and raw materials to France. In addition, the Treaty assessed some $40 billion in reparations against Germany to compensate the victorious powers for war damages, a sum that was about three times Germany’s pre-war GDP.

The Allied leaders adopted this approach in order to reduce German power to a level commensurate with that of France and Great Britain, and thus to restore something resembling the pre-war balance of power among the major European states. Keynes judged this to be a wrongheaded and self-defeating approach. “My purpose in this book,” he wrote, “is to show that the Carthaginian Peace is not practically right or possible. The clock cannot be set back. You cannot restore Central Europe to 1870 without setting up such strains in the European structure and letting loose such human and spiritual forces as will overwhelm not only you and your ‘guarantees,’ but your institutions and the existing order of your society.” In Keynes’s view, the Allied statesmen should have focused more on economic relief and reconstruction, and far less on borders, reparations, and restoring the pre-war balance of power.

The Paris Peace Conference marked a turning point when Keynes saw that the ideals and institutions of the pre-war era could no longer serve as the foundations for progress in the post-war era. The faith in automatic progress through saving and self-discipline had been shattered. National currencies and terms of trade were distorted by wartime inflation. Workers would henceforth demand a greater share of the fruits of capitalism than they were willing to accept prior to 1914. Keynes thought that this pointed toward new roles for the state, labor unions, and corporations in the evolution of capitalism. As he wrote, “The forces of the nineteenth century have run their course and are exhausted. The economic motives and ideals of that generation no longer satisfy us. We must find a new way and must suffer again the malaise, and finally the pangs of a new industrial birth.” At this point, no one, least of all Keynes, knew what shape the new order might take.

Read More: World War I, Treaty of Versailles

The Evolution of Capitalism

In a series of essays he wrote during the 1920s, and which he collected into a single volume under the title Essays in Persuasion (1931), Keynes reflected on the evolution of the capitalist order from its origins in the eighteenth century and on the significant changes in the international system brought on by the war. In these essays, Keynes maintained that rapid changes in the economic order required parallel adjustments in economic and political theory.

Keynes envisioned an emerging system of capitalism in which large business enterprises and not-for-profit institutions operated alongside government in common efforts to promote the public interest. The friction between the public and private spheres, so much an aspect of the old order of liberalism, was giving way to a new order of cooperation among large institutions. Keynes’s corporatist vision of the capitalist order represented an evolution of liberalism beyond its nineteenth-century emphasis upon individuals, market competition, and suspicion of the state.

The rise of institutional capitalism brought with it a new separation of ownership and control in large organizations. In the past, individual entrepreneurs managed the enterprises they created, but now control was passing into the hands of expert managers who responded to different incentives. In “The End of Laissez Faire,” a pamphlet he published in 1926, Keynes observed that “A point arrives in the growth of a big institution – a big railway or public utility enterprise but also a bank or insurance company – at which the owners of capital are almost entirely dissociated from the management, with the result that the direct personal interest of the owners (the shareholders) becomes quite secondary.” The new managers, in contrast to the founding entrepreneurs, are interested in other goals besides profit, such as stability, security of employment, reputation, and independence. Keynes also welcomed the development of semi-autonomous, not-for-profit institutions such as universities and scientific societies that promote the general interest in different spheres of activity.

Keynes pointed to two areas where the state could and should intervene to improve the operation of the modern capitalist order. The first was in the area of money and credit, where he called for deliberate control and planning by a central institution—that is, by a central bank with powers sufficient to regulate the supply of currency and credit toward the goal of full employment and stable prices. This was an implicit attack on the gold standard, which Keynes regarded as an archaic inheritance from the nineteenth century, and in the wake of the war an ineffective instrument for regulating money and credit. His second innovation was to call for public control over investment such that the state would replace banks, investment houses, and wealthy individuals as the major supplier of investment capital. In the modern world, he pointed out, “savers” and “investors” were now different people and institutions; their decisions had to be coordinated by private intermediaries that took in savings and directed them toward new and hopefully profitable enterprises. Keynes had little faith that this process could be carried out seamlessly in the public interest, and so he looked to the state as the institution where the investment function could be carried out rationally in the interests of society as a whole.

Keynes was optimistic that the slump of the 1930s was but a temporary lapse in the onward march of capitalist development. He dismissed claims that the Depression marked the end of prosperity or the collapse of the capitalist system. In an essay on the “Economic Possibilities for Our Grandchildren,” he wrote that “We are suffering, not from the rheumatics of old age, but from the growing pains of over-rapid changes, from the painfulness of readjustment between one economic period and another.” This was the painful adjustment from the age of laissez faire to the age of institutional capitalism. Keynes calculated that over the previous one hundred years the standard of living of the average European and American had grown at least four-fold, and that over the next one hundred years it would improve between four and eight times. Within two or three generations, he predicted, the necessities of the comfortable life would be available to all. More profoundly, according to Keynes, mankind’s long struggle for survival in the face of scarcity would then be near an end.

Like many other thinkers of his era, Keynes viewed the political and moral principles associated with market capitalism to be degrading and in need of replacement by a more humane system of ideals. There was an evolutionary or historical element in Keynes’s thought: He claimed that capitalism developed in historical stages and also in a morally favorable direction. Institutional capitalism was an improvement over the “classical” system of the nineteenth century, but still a stepping-stone on a path to the next phase of capitalist development when the “economic problem” might be solved once and for all.

Read More: Monetarism

The Great Depression and The General Theory

The General Theory is universally regarded as the more important of Keynes’s two major works because in it he laid out the theoretical case for counter-cyclical government spending policies that proved to be so influential in the post-war era. Though his two influential books were very different in style, substance, and purpose, both hammered at a common theme: the obsolescence of the old order in Europe.

The extended slump of the 1930s formed the background for Keynes’s treatise. The industrial economies had gone through recessions and even depressions in the past, but none as deep and prolonged as the collapse in the 1930s. Keynes was as surprised as everyone else by the severity of the slump. Disasters of this magnitude were not supposed to happen in market economies that were thought to possess self-correcting features. When the slump continued, and grew worse in the early 1930s, Keynes concluded that there was something wrong with the adjustment mechanisms of the market that was not accounted for in the standard economic theories. For Keynes, much like the Great War, the Great Depression called into question the received wisdom of the time.

In The General Theory, Keynes mounted an attack on what he called the “classical” school of economics, the doctrine of free and self-adjusting markets developed by the political economists of the previous century. The classical theory, he suggested, is not a general theory but rather a special theory applicable to a condition of full employment and to an era of small producers, independent workers, and competitive markets, circumstances that no longer obtained in modern economies increasingly dominated by large institutions and, importantly, by labor unions. A central theme of Keynes’s theory, and of Keynesian economics in general, is that market economies do not automatically adjust to systemic shocks like stock market crashes, widespread bank failures, famines, and wars. A second is that the market system, left on its own, will operate most of the time at levels below full employment and potential output.

Keynes argued in The General Theory that there exists no automatic process of adjustment in wages, prices, and interest rates that would correct the slide in employment and output. Under the right circumstances, there could be a general over-production of goods, widespread unemployment, hoarding of money by consumers, and a collapse of investment—all occurring at the same time and in response to one another. This meant that the market might reach equilibrium at levels well below full employment—and Keynes argued that this was in fact what had happened in the 1930s.

The basic problem according to Keynes, and the reason market economies often fall short of potential output and “over shoot” both on the up and down sides, is that investors and businesses must make calculations about spending and hiring in the face of a fundamentally uncertain future. Investors are the “prime movers” of the economy, and also the source of market volatility. Consumers, by contrast, behave fairly predictably, spending a stable percentage of their incomes on goods and services of various kinds, except on occasions when fear and panic lead them to reduce expenditures and increase savings. Investors, on the other hand, must allocate funds and hire employees based upon uncertain assessments of conditions many years into the future. “Our knowledge of the factors that will govern the yield of an investment some years hence is usually very slight and often negligible,” he wrote in The General Theory. To complicate matters further, the evolution of stock markets requires investors to make judgments about how other investors assess the future—since those assessments, when added up, determine the value of stocks and potential returns on investment.

Keynes drew a portrait of the market economy that was close to the opposite of that drawn by his eighteenth- and nineteenth-century predecessors. They saw a system that operated like a machine with its various parts working in tandem to keep it moving forward, even in the face of external shocks that might slow it down but could not knock it off course for very long. In their view, entrepreneurs and investors were the rational and calculating participants that kept the economic machine moving. Keynes described a system that was inherently prone to booms and busts because its various parts did not work in harmony and because it was greatly influenced by shifting investor moods—or “animal spirits,” as he called them. In his theory, investors and business entrepreneurs were the dynamic but capricious elements, putting their funds into play and withdrawing them based upon those shifting moods about future prospects and in response to the spending and saving decisions of consumers.

This relationship between consumers and investors gave the system a “pro-cyclical” bias: Consumers and investors increased their spending in tandem with one another, but also withdrew it according to a reciprocal dynamic. This was one of the relationships that gave the market system its “boom and bust” character. Keynes looked to government spending and borrowing as a counter-cyclical factor that might stabilize the system, particularly during slumps when consumer hoarding and investor pessimism send the economy into a downward spiral. Government could borrow and spend when entrepreneurs and consumers would not or could not. This element of his theory—the new role for government—represented his most radical departure from the approach of his nineteenth-century predecessors. Keynes now viewed government as a player and partner in the capitalist process, rather than as a rival to business and a threat to individual liberty. This meant many things in practice, but most importantly that national governments must assume a greater role in maintaining employment, promoting growth, and intervening with new spending to reverse slumps.

Read More: Great Depression, Business Cycle

World War II and Bretton Woods

When World War II began, Keynes once again took on the role as advisor to the British Treasury. Because of his experience in World War I and his prominence as an economic theorist, Keynes knew more than anyone alive about the intricacies of international lending. He was involved in negotiations with the United States over the “Lend-Lease” program in 1941 and at the end of the war negotiated a $3.75 billion loan from the United States that allowed Britain to purchase needed supplies abroad at a time when the country was effectively broke. As World War II neared its end, American and British planners were determined to avoid the errors of 1918 and 1919. The remedies Keynes proposed in 1919 — relief, reconstruction, renewal of trade, cancellation of debts, renouncement of reparations — were generally accepted in 1945 as guideposts for the post-war order.

Keynes was also the chief British negotiator at the Bretton Woods (New Hampshire) Conference in 1944 where representatives of forty-four allied nations created the institutional foundations of the post-war economic order. Keynes was the most influential figure at the conference in making the case that the international system was in need of new arrangements to replace the gold standard that would encourage debtor and creditor nations to work together to promote lending, trade, and economic growth. Keynes argued for the creation of a new international currency to facilitate trade and settle international accounts but was over-ruled by American negotiators who wanted an international regime in which national currencies were pegged to the U.S. dollar. Keynes did succeed in winning support for two principal pillars of the post war economic order: the World Bank to finance development projects and the International Monetary Fund to provide emergency loans to debtor countries temporarily unable to finance trade.

Read More: Bretton Woods, World War II

Keynes’s Post-War Legacy

Many attributed the rapid growth in America’s post-war economy to the application of Keynes’s theories. In 1965, Time took note of his vast influence by publishing a cover story under the title, “We Are All Keynesians Now.” As the magazine acknowledged, “Keynes and his ideas, though they still make some people nervous, have been so widely accepted that they constitute both the new orthodoxy in the universities and the touchstone of economic management in Washington.” As the magazine suggested, Keynes’s theories took over the economics profession in the post-war era and provided the framework for new ways of analyzing the business cycle, unemployment, and the potential contributions of government spending to stable growth.

During the 1970s, an unprecedented combination of high unemployment and double-digit inflation caused many economists and policy-makers to lose confidence in Keynes’s theories and to look elsewhere for policy prescriptions. At this time, monetary economists gained the upper hand in explaining the sources of inflation and unemployment and in pointing to central bank policies rather than government spending as principal remedies. Though Keynes’s theories were temporarily in retreat in Washington and London during the 1980s and 1990s, they never really lost influence among academic economists who continued to insist that market economies are inherently unstable and that government spending funded by debt is an effective remedy for recessions and unemployment. The recent financial crisis has provided a new occasion for the application of Keynes’s theories.

Keynes’s theories remain controversial, especially among those who are skeptical of the large role governments have seized in economic affairs. Many skeptics point to the difficulties of applying Keynesian remedies in the real world where politicians make government budgets far more in response to political pressures than to requirements of economic growth. Economists still debate the rapidity with which market economies adjust to shocks, the extent to which government debt produces real growth versus inflation, or whether investors operate under a cloud of uncertainty or view the future in terms of rational expectations. Yet, in spite of such controversies, the fact remains that Keynes’s theories were instrumental in building the modern state, just as John Locke’s or Adam Smith’s writings were seminal in the formation of the limited state of the eighteenth and nineteenth centuries. For this reason, they will not be overcome by theoretical arguments alone but will undoubtedly remain influential so long as the political settlements arrived at in the 1930s and 1940s survive intact.

–Essay by James Piereson

Other Sites of Interest

John Maynard Keynes – Concise Encyclopedia of Economics

John Maynard Keynes – Online Library of Liberty

Papers of John Maynard Keynes – King’s College Archive Centre, University of Cambridge