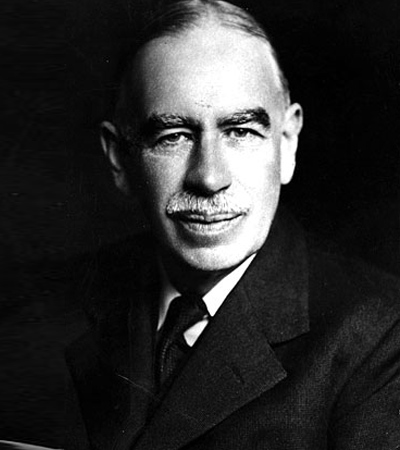

Biography

John Maynard Keynes was born in Cambridge, England, on June 5, 1883, the son of John Neville Keynes and Florence Ada Brown Keynes. His father was a prominent professor of political economy at the University of Cambridge; his mother was active in local politics and served a term as mayor of Cambridge. Keynes would live nearly his entire life as a resident of Cambridge, save for brief periods when he was away at boarding school or traveling in public service.

Keynes received his education at Eton College and at King’s College, Cambridge, where he received a degree in mathematics in 1905 (he never earned a formal degree in economics). Keynes entered civil service in 1906, working in London in the India Office on problems of Indian currency and finance. Disliking that experience, he abandoned the civil service to return to Cambridge to prepare a dissertation in probability theory and to study economics under Alfred Marshall, who urged him to pursue a career in the field. On the basis of this work, Keynes was elected a fellow at King’s College in 1909 and appointed as a lecturer in economics in that same year.

Shortly after the outbreak of the war, Keynes accepted a position in the British Treasury, where he rose quickly as an authority on inter-ally finance. After the United States entered the conflict in 1917, he worked with officials in the U.S. Treasury to arrange American loans to her European allies. As the end of the war approached, Keynes was assigned to a team charged with calculating what Germany could realistically afford to pay in compensation for war damages. These calculations were modest compared with the exorbitant charges some Allied leaders were demanding.

Following the German surrender, Keynes went to France as a Treasury representative to the Paris Peace Conference organized to hammer out a final settlement to the war. Keynes spoke behind the scenes in favor of a moderate settlement with regard to German reparations. He opposed overly punitive measures toward the defeated powers and urged his colleagues instead to focus on European recovery and reconstruction. When it was clear by June (1919) that Keynes had lost this argument, he resigned his position at the Conference and returned to England to write a book on what he considered to be a failed treaty. The Economic Consequences of the Peace, written in three months and published late in 1919, was a powerful broadside against the Treaty of Versailles and an international best seller. In the book, Keynes attacked the Conference for producing a “Carthaginian Peace” and predicted that it would lead to another war.

Keynes, now a prominent intellectual figure, returned to Cambridge to lecture, tutor pupils in economics, and write on contemporary affairs. Keynes made and lost sizeable sums speculating in international currencies and took over management of the King’s College endowment. He maintained friendships with members of the “Bloomsbury Group,” a circle of prominent artists and writers (Virginia Woolf and Lytton Strachey among them) in London bent on overturning Victorian moral standards. Keynes, an active homosexual in his twenties and thirties, was married in 1925 to Lydia Lopokova, a Russian ballerina and sometime member of the Group.

In the meantime, he contributed essays to liberal journals and newspapers on German reparations, monetary policy, and the gold standard. In A Tract on Monetary Reform (1923) Keynes called for stable currencies managed by central banks and opposed a return to the gold standard on the grounds that such a policy assigns priority to the exchange value of the currency at the expense of domestic employment. When Britain returned sterling to the gold standard in 1926 at pre-war parities, Keynes wrote that (because the pound was over-valued) the move would lead to wage cutting, unemployment in the export industries, and domestic unrest. The general strike of 1926 seemed to vindicate this forecast. In 1931, as the Depression took hold, Britain abandoned the gold standard in an effort to stem the tide of deflation and domestic unemployment.

The economic collapse of the 1930s caused Keynes to question the conventional assumption that the free market corrects for declines in employment and output through automatic adjustments in prices, wages, and interest rates. The length and depth of the Depression suggested that there was something about the market system that kept it from adapting quickly to shocks like bank failures, stock market crashes, and wars. Keynes (like many others) called on national governments to respond to the business slump by adopting spending and public works programs. He wrote an open letter to President Roosevelt in 1933 in praise of the New Deal but encouraging the President to focus more on spending programs to prop up consumer demand and less on counter-productive bureaucratic schemes like the National Industrial Recovery Act that discouraged business investment.

In 1936, Keynes published The General Theory of Employment, Interest, and Money in an attempt to recast economic theory to explain the prolonged slump of the 1930s. Keynes argued that economists beginning with Adam Smith assumed full employment to be the normal state of affairs when in fact that condition seemed more the exception than the rule. He pointed to several aspects of the market process that kept it from adapting quickly to shocks and therefore made it operate for long periods well below full employment. His theory suggested that during slumps governments could borrow and spend to support consumer demand, which in turn would encourage businesses to invest in plant, equipment, and people. His book quickly caught on among economists and policy makers because it offered practical solutions to the economic troubles of the time. Keynes’s theory soon revolutionized the study of economics in universities in Great Britain and the United States.

During World War II, Keynes once again took on the role as advisor to the British Treasury. He was involved in negotiations with the United States over the “Lend-Lease” program in 1941 and at the end of the war negotiated a $3.75 billion loan from the United States that allowed Britain to purchase needed supplies abroad at a time when the country was effectively broke. Keynes was also the chief British negotiator at the Bretton Woods conference in 1944 where representatives of forty-four allied nations created the institutional foundations of the post-war economic order: the World Bank, the International Monetary Fund, and an international currency regime pegged to the U.S. dollar.

Keynes’s role with the Treasury during the war required him to make many demanding trips back and forth to the United States to represent British interests in complex negotiations. He had suffered a mild heart attack in 1937, and the burdens of wartime work took a further toll on his health. Keynes returned to Great Britain exhausted following a final trip to the United States in late winter of 1946. On April 21, 1946, he died of a heart attack at age 62 at his home in Cambridge. Both of his parents survived him.

Born:

June 5, 1883, in Cambridge, England, U.K., son of John Neville Keynes, an influential economist on the faculty of the University of Cambridge, and Florence Ada Brown Keynes, social reformer and local political figure in Cambridge

Education:

King’s College, University of Cambridge, B.A. in Mathematics (1905)

Religion:

None

Career Highlights:

Fellow, King’s College, University of Cambridge, 1909-1946; Lecturer in Economics, King’s College, University of Cambridge, 1909-1937; Member of British delegation (Treasury Representative), Paris Peace Conference (1919); The Economic Consequences of the Peace (1919); A Tract on Monetary Reform (1923); The General Theory of Employment, Interest, and Money (1936); Advisor to the British Treasury (1940-46); Awarded a Peerage, takes seat in House of Lords as member of the Liberal Party (1942); Member of the British delegation, United Nations Monetary and Financial Conference at Bretton Woods, N.H. (1944)

Family:

Married Lydia Lopokova, Russian ballerina, in 1925; no children

Death:

April 21, 1946, in Cambridge, England, of a heart attack

Notable Quotations:

“The long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is past the ocean is flat again.” – A Tract on Monetary Reform (1923)

“I expect to see the State, which is in a position to calculate the marginal efficiency of capital goods on long views and on the basis of the general social advantage, taking an ever greater responsibility for directly organizing investment.” – The General Theory of Employment, Interest, and Money (1936)

“The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Practical men, who believe themselves to be exempt from any intellectual influences, are usually the slaves of some defunct economist. Madmen who hear voices in the air are distilling their frenzy from some academic scribbler of a few years back. I am sure that the power of vested interests is vastly exaggerated compared with the gradual encroachment of ideas.” – The General Theory of Employment, Interest, and Money (1936)